does california have real estate taxes

California does not have an inheritance tax estate tax or gift tax. For the State the law is written.

California Property Taxes Post Proposition 19 The Makeover Cerity Partners

If you live in California you can get free tax help from these programs.

. Rental activities even if you do materially participate in them unless you are a real estate professional. The state of Wisconsin charges the transfer tax based on the sale price. In California retirement accounts and pension plans are.

In California a single taxpayer can save up to 250000. The median property tax in California is 283900 per year for a home worth the median value of 38420000. The federal estate tax goes into effect for.

That means taxes are calculated by the value of the home. Volunteer Income Tax Assistance VITA if you. A capital gain from the sale of real estate located in CA is CA-source income.

However the federal gift tax does still apply to residents of California. California does not levy a gift tax. The Golden State also has a sales tax of 725.

If you or your spouse actively participated in a. Even though California does not have its own estate and inheritance taxes it is still one of the highest tax states in the country. Federal Estate Tax.

The best way to avoid capital gains tax on the sale of your California residential real estate is to take full advantage of the exemption. The governing withholding laws California Code of Regulations Title 18 Sections 18662-0 through 18662-6 and Section 18662-8 were revised and were effective as of November. Your gain from the sale was less than 250000.

They charge at a rate of 030 for every 100 or fraction thereof of the purchase price. You do not have to report the sale of your home if all of the following apply. Tax amount varies by county.

However California residents are subject to federal laws governing gifts during their lives and their estates after they die. Property tax in California is calculated by something called Ad Velorum. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains.

October 2 2019 921 AM. California taxes non-residents on CA-source income. Property 2 days ago 8.

The tax rate is 1 of the total home. The State regulations regarding withholdings on real property sales is a little different from the Federal withholding of foreigners under the FIRPTA guidelines. Get free tax help FTBcagov - California.

074 of home value. You have not used the exclusion in the last 2 years. This article provides an overview of the California real estate transfer tax system and then identifies some of the jurisdictions that have expanded the scope of the tax.

No California estate tax means you get to keep more of your inheritance. Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider.

The Property Tax Inheritance Exclusion

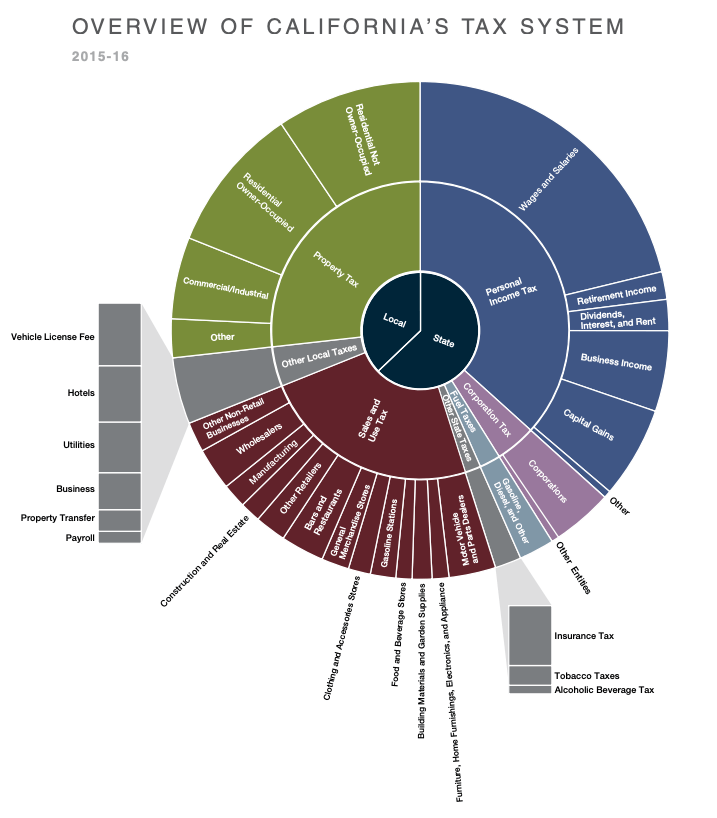

Understanding California S Property Taxes

California Tax Rates Rankings California State Taxes Tax Foundation

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Orange County Homes With No Mello Roos Orange County Mello Roos Properties

Calif Courts Create Tax For Llcs Holding Real Estate Corporate Direct

What You Should Know About Property Taxes In California Nicki Karen

Interactive Map Compares Californians Property Taxes

The Real Estate Tax Implications Of California Prop 19 Certified Tax Coach

Property Tax Calculator Estimator For Real Estate And Homes

California Property Taxes Explained

At What Age Do You Stop Paying Property Tax In California Best Tax Service

Prop 13 Offers Higher Tax Breaks For California Homeowners In White Neighborhoods

California Real Estate Prop 13 And Property Taxes Kkos Lawyers

Property Tax Calculator Estimator For Real Estate And Homes

Understanding California S Property Taxes

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100