are charitable raffle tickets tax deductible

Are Nonprofit Raffle Ticket Donations Tax Deductible. Basically the IRS treats it like gambling or specifically nondeductible gambling losses because youre not selflessly donating to charity but rather playing the odds in hopes of receiving something of.

Tax Deductible Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Rece Receipt Template Letter Template Word Donation Form

However if you dont accept the ticket at the time of making the donation or send it back to the charity soon after receiving it you arent receiving a benefit and therefore the entire 100 price is deductible.

. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Chapter 345 of HMRCs Gift Aid guidance states. This means that purchases from a charity that involve raffle tickets items or.

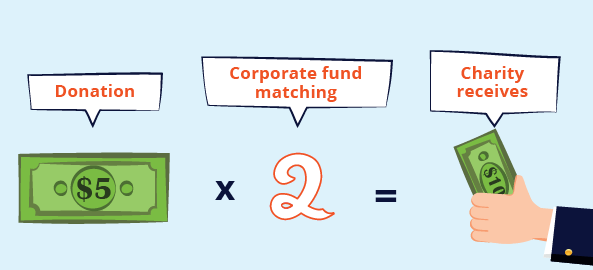

If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater than the value of the benefit you receive. Exempt under section 501 of the Internal Revenue Code. The IRS considers a raffle ticket to be a contribution from which you benefit.

Please consult your accountant or tax professional for further information. If you win the raffle you may even end up owing tax. For example if the ticket price is 100 and the fair market value of the food andor entertainment received at the event is 25 per donor the portion of the ticket price that is deductible as a charitable contribution is 75.

For specific guidance see this article from the Australian Taxation Office. Buying a ticket lets you help your community but it doesnt help you claim a deduction for a charitable donation. However many of these crowdfunding websites are not run by DGRs.

Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket. The purchase of a raffle ticket to support a nonprofit is technically not deductible. Unfortunately fund-raising tickets are not deductible.

It is the responsibility of the organization putting on the event to determine the FMV and to inform the participants of the amount of the contributed portion. A tax-exempt organization that sponsors raffles may be required to secure information about the winners and file reports on the prizes with the Internal Revenue Service. Buying a raffle ticket to support a nonprofit organization is not a deductible expense.

Charitable Deduction The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. The tax-deductible or contributed portion of a ticket is the amount over and above the fair market value FMV of any benefits received. This is because the purchase of raffle tickets is not a donation ie.

Payments to a charity in return for services rights or goods are not gifts to charity and so are not eligible for the Gift Aid Scheme. When you accept the ticket but choose to not attend the dinner however the tax rules treat your acceptance of the ticket as a 40 nondeductible benefit since possession of it still. Payment for raffle or lottery tickets including 100 clubs the payment to purchase a.

Websites like Zacks provided some of the most clarity on how the IRS treats charity raffle tickets. There are many examples of contributions that are not tax deductible even if you make them to a tax-exempt organization. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

Tuition made to a private or parochial school. The organization may also be required to withhold and remit federal income taxes on prizes. For information on how to report gambling winnings and losses see Expenses You Can Deduct in Pub.

The irs has adopted the position that the 100 ticket price is not deductible as a charitable donation for federal income tax purposes. Can a raffle ticket be tax deductible. What Donations Are not Tax Deductible.

A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts. For a donation to be tax deductible it must be made to an organisation endorsed as a Deductible Gift Recipient DGR and must be a genuine gift you cannot receive any benefit from the donation. You cant deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance.

For example in recent times crowdfunding campaigns have become a popular way to raise money for charitable causes. Raffle or lottery tickets. Raffle Tickets even for a charity are not tax-deductible.

By this we mean that purchases of raffle tickets meals and items offered as gifts by charities are not deductible. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by organizations to raise money. For example the following cannot come within the Gift Aid Scheme.

For all tickets 75 and over the non-profit organization must furnish the. The portion of the admission or ticket price that equals the value of goods or services the donor receives at the event is not deductible. This is because you are betting on your chance of winning a lottery ticket instead of making a charitable donation.

Some donations to charity can be claimed as tax deductions on your individual tax return each year. In general individuals can claim donations they make to charity on their tax returns each year as tax deductions. Raffles tickets arent deductible as charitable donations even if the tickets are sold by nonprofitsTickets for raffle are treated as contributions by the IRS that benefit you.

Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket. The Internal Revenue Service has a complete list of the types of organizations where charitable donations might be tax deductible. The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses.

There is the chance of winning a prize. Not all charities are DGRs. The IRS classes money spent on raffles and lotteries as contributions from which you benefit and therefore it is generally not deductible.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. The IRS considers a raffle ticket to be a contribution from which you benefit.

Are Charity Raffle Tickets Tax-Deductible.

Tax Deductible Donations Reduce Your Income Tax The Smith Family

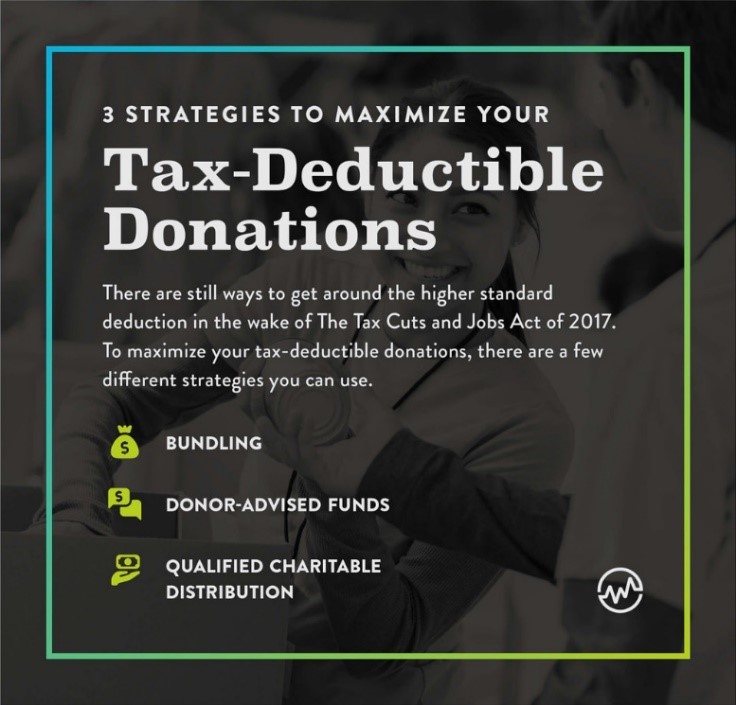

Bundling Can Provide Tax Advantages Catholic United Financial

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Pin By Heather Dunn On Real Estate Info Competition Info Person

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

501c3 Tax Deductible Donation Letter Check More At Https Nationalgriefawarenessday Com 505 Donation Letter Donation Letter Template Donation Thank You Letter

Fundraising How To S Ten Ways To Say Thank You Fun Fundraisers Fundraising Sayings

Sample Donation Receipt Receipt Template Tax Deductions Business Template

5 Donation Receipt Templates Free To Use For Any Charitable Gift Lovetoknow Donation Letter Donation Letter Template Receipt

Sample Donation Receipt Letter Documents Pdf Word Acknowledgement Templates Free Samples Examples For Donation Letter Template Donation Letter Letter Templates

Charitable Donation Receipts Requirements As Supporting Documents For Tax Deductible Donations Donation Letter Donation Letter Template Donation Form

What Is A Tax Deductible Donation To A Nonprofit Organization Nonprofit Startup Nonprofit Fundraising Non Profit Donations

Tax Relief For Charitable Donations

Charitable Deductions On Your Tax Return Cash And Gifts

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Fun Fact Charity Raffle Tickets Are Not Tax Deductible